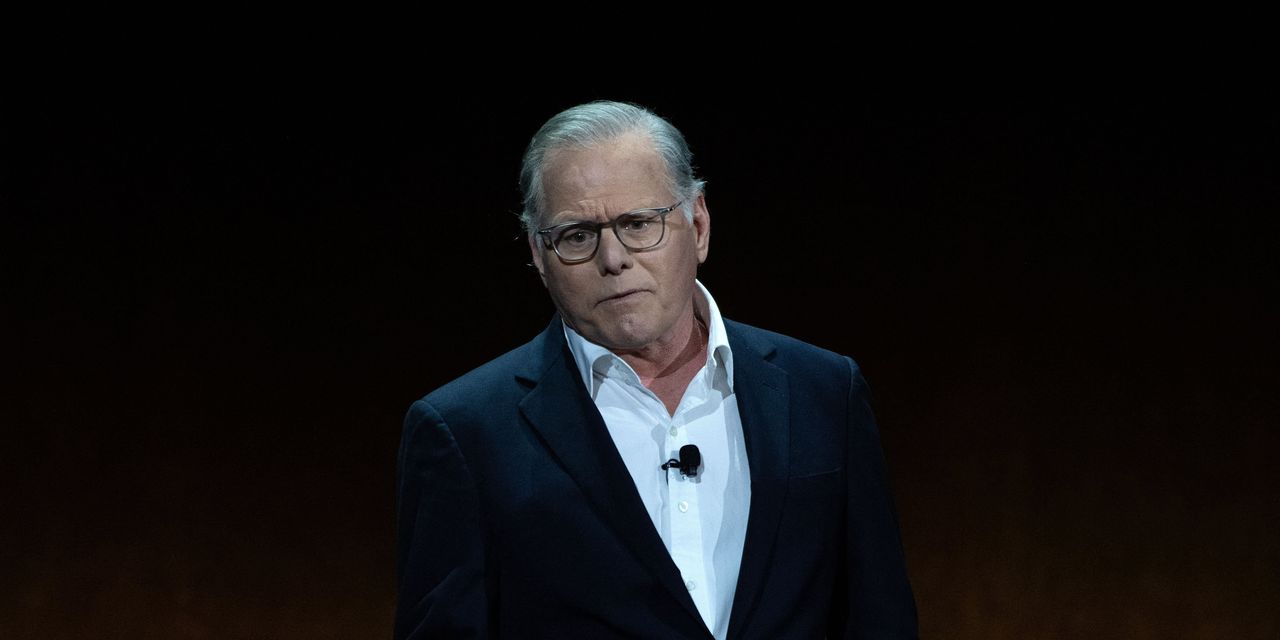

Warner Bros. Discovery CEO Zaslav Not Ready To Make Deal For Paramount

Warner Bros. Discovery Zaslav not ready to make deal for Paramount and that his talks about a possible partnership with rival studio Paramount Global are more exploratory.

Author:Alex MercerReviewer:Nathanial BlackwoodDec 25, 202321.4K Shares476.1K Views

Warner Bros. Discovery Zaslav not ready to make deal for Paramountand his talks about a possible partnership with rival studio Paramount Global are more exploratory. This suggests that rumors of a near-term mega-media merger between the two companies are more wishful thinking than reality.

That doesn't mean that such a deal is off the table, and these people say that there might not be a way to make a relationship work that leads to a merger in the end. Tuesday, Zaslav met with Paramount CEO Bob Bakish.

The main topic of their conversation was how to sell Shari Redstone's share in National Amusements, which owns Paramount. National Amusements is the holding company for Redstone's slowly falling media empire, which includes CBS, its sports programming, MTV, Comedy Central, Nickelodeon, and the losing streaming service Paramount+.

Warner Bros. Discovery Zaslav Not Ready To Make Deal For Paramount

There are rumors of a merger because the CEOs of Warner Bros. Discover and Paramount (PARA) Global met earlier this week to talk about taking their businesses together. As reported by Axioson December 20, the two leaders met at Paramount's headquarters in New York City on December 19 for several hours to talk about how an acquisition could help them, especially in the streaming market.

If WBD bought Paramount, it would create a huge company with a lot of different businesses. In particular, if Zaslav were to buy Netflix or The Walt Disney Company, he could compete with their streaming services by merging Max and Paramount+.

It could also give both companies the right to watch big sports events like March Madness and the Champions League in the U.S., as well as the NFL on CBS franchises. WBD could also make a lot of money from cable, parks, experiences, and content licensing if the two companies join.

There is a lot of talk about what will happen to Paramount after this news. Hari Redstone, who owns a lot of shares and has a lot of power, is said to be eager to make a deal. Redstone runs Paramount through her business, National Amusements.

People who know about the talks say that Redstone recently met with David Ellison's company Skydance, which is backed by Gerry Cardinale's investment business RedBird. The movie studio Paramount and the TV network CBS are among Paramount's assets, but the company also has a lot of debt.

Zaslav, who has worked in the media industry for a long time, planned the Time Warner-Discovery merger that happened in April 2022 and brought together networks like HBO, CNN, the Food Network, the Cartoon Network, and Warner Bros. Studio.

NBCUniversal was owned by General Electric at the time and led by the late and famous cost-cutting leader Jack Welch, who was also known as "Neutron Jack." He learned how to combine businesses very well while working for General Electric.

According to people close to Zaslav, Welch taught him a lot. In typical Welch style, he has paid off almost $12 billion in debt since the Time Warner deal and now has $5 billion in free cash flow to look for acquisitions. Zaslav has said that he wants to gain more business for Warner Bros. Discovery by buying other companies.

It's not a good time to run a media company, in case you didn't notice. Comcast is making a lot of money right now by combining cable, internet, and NBCUniversal's many shows. But its stock price is a long way from where it was at its peak.

Investors think that bad ad sales, cord-cutting, and other factors will lead to slow earnings growth. Comcast's internet business isn't doing well. The movie theater business lost $3 billion this year because fewer people went to the movies.

Final Words

It is a "very early stage" in the talks between David Zaslav of Warner Bros. Discovery and the people at Paramount about merging their companies. It feels like both sides are desperate, and so is the media business as a whole.

The person named "Zas" is doing a great job (even though it's hard) joining WarnerMedia and Discovery as CEO of Warner Bros. Discovery. Along with getting rid of merger debt, he is simplifying things. He has $5 billion that he can spend on anything he wants. His stock has come a long way since the lows it hit after the merger when people bet Zas would be bankrupt.

Alex Mercer

Author

Alex Mercer is a seasoned author and analyst specializing in wealth research, with a keen focus on evaluating the net worth of individuals across various industries. With over a decade of experience in financial analysis and wealth assessment, Alex has developed a nuanced understanding of the factors that contribute to an individual's financial status, from investments and assets to market trends and economic policies. His work involves in-depth reviews and analyses, providing insightful observations on wealth accumulation, management strategies, and the socio-economic implications of wealth distribution.

Throughout his career, Alex has become known for his ability to distill complex financial data into understandable and engaging narratives, making the subject of wealth and net worth accessible to a broad audience. His expertise is not just in numbers but in telling the stories behind them, highlighting the journeys, strategies, and decisions that lead to financial success or challenges. Alex's contributions to the field of wealth research are valuable resources for anyone looking to understand the dynamics of wealth in today's world, offering a unique perspective that bridges the gap between financial analysis and human interest.

Nathanial Blackwood

Reviewer

Nathanial (Nate) Blackwood is a distinguished financial journalist with a decade of experience in net worth analysis. He holds an Economics degree from the University of Finance and a Data Analysis certification, enabling him to blend thorough insights with engaging storytelling. Nate is known for making complex financial information accessible to a wide audience, earning acclaim for his precise and reader-friendly analyses. Beyond his writing, Nate is dedicated to financial literacy, actively participating in educational forums and workshops.

He is the founder of PureNetWealth, a platform that demystifies the financial achievements of public figures by exploring the strategies and decisions behind their fortunes. Nate's work bridges the gap between intricate economic concepts and the general public, inspiring a deeper understanding of wealth dynamics. Follow Nathanial Blackwood for essential insights into the financial narratives shaping our world.

Latest Articles

Popular Articles